How to become a non-UK tax resident

According to the Income Tax Act ("ITA") of United Kingdom ("UK"), income from all sources of a tax resident of UK is subject to income tax, including foreign sources.

Interestingly, while global income of a UK tax resident is taxed by HM Revenue

& Customs ("HMRC", the tax authority in UK), they are taxed separately based on the nature of the income. ITA distinguishes between "non-savings income", "savings income" and "dividend income", and they have quite different taxing rules. Anyway, they are all taxed once you are a tax resident of the UK.

Even though you can save a lot of tax by building your tax residence in Hong Kong ("HK"), you should also become a non-UK tax resident at the same time, otherwise your global income would be taxed by HMRC even though it would not be taxed by Inland Revenue Department ("IRD", the tax authority in HK).

Please note that, if a UK resident does not have a domicile in the UK may, in certain circumstances, elect for his/her foreign income and gains to be taxed on the remittance basis. However, the domicilation rules in UK will probably be reformed in 2025.

1 Statutory residence test

On 6 April 2013, statutory residence test ("SRT") was introduced as a statutory definition of tax residence. SRT provides three tests in determining whether you are tax resident of the UK, including:

- Automatic overseas tests

- Automatic UK residence tests; and

- Sufficient ties tests

If you have successfully passed the automatic overseas tests, you will be treated as a non-UK tax resident. If you have failed automatic UK residence tests AND sufficient ties tests, you will also be treated as a non-UK tax resident.

2 Automatic overseas tests

There are three sub-tests of automatic overseas tests. You will be treated as a non-UK tax resident as long as you meet ONE of them.

2.1 Spending fewer than 16 days in the UK

You will be a non-UK resident for the tax year if you were resident in the UK for one or more of the 3 tax years before the current tax year, and you spend fewer than 16 days in the UK in the tax year.

2.2 Spending fewer than 46 days in the UK

You will be a non-UK resident for the tax year if you were resident in the UK for none of the 3 tax years before the current tax year, and spend fewer than 46 days in the UK in the tax year.

2.3 Spending fewer than 91 days in the UK

You will be a non-UK resident for the tax year if you spend fewer than 91 days in the UK in the tax year and meet ALL of the requirement below:

- you work full-time overseas over the tax year;

- the number of days on which you work for more than 3 hours in the UK is less than 31;

- there is no significant break from your overseas work

- A significant break is when at least 31 days go by and not one of those days is a day where you:

- work for more than 3 hours overseas

- would have worked for more than 3 hours overseas, but you did not do so because you were on annual leave, sick leave or parenting leave

- A significant break is when at least 31 days go by and not one of those days is a day where you:

To summarize, if you spend 91 days or more in a tax year in the UK, you cannot use automatic overseas tests to qualify yourself as a non-UK tax resident. The fewer days you spend in the UK, the easier you meet the tests.

Golden rules - try your best not to visit the UK if you want to be a non-UK tax resident.

3 Automatic UK residence tests

There are three sub-tests of automatic UK residence tests. You will be treated as a non-UK tax resident only if you meet NONE of them.

3.1 Spending more than 183 days in the UK

You will be a UK resident for the tax year if you spend 183 days or more in the UK in the tax year.

3.2 Having a home in the UK

You will be a UK resident for the tax year if you have a home in the UK for all or part of the year and the following all apply:

- there is or was at least one period of 91 consecutive days when you had a home in the UK;

- at least 30 of these 91 days fall in the tax year when you have a home in the UK and you’ve been present in that home for at least 30 days at any time during the year; and

- at that time you had no overseas home, or if you had an overseas home, you were present in it for fewer than 30 days in the tax year

If you have more than one home in the UK you should consider each of those homes separately to see if you meet the test. You need only meet this test in relation to one of your UK homes.

3.3 Working in the UK

You will be a UK resident for the tax year if you work full-time in the UK for any period of 365 days, which falls in the tax year, and the following all apply:

- more than 75% of the total number of days in the 365 day period when you do more than 3 hours work are days when you do more than 3 hours work in the UK; and

- at least one day which has to be both in the 365 day period and the tax year is a day on which you do more than 3 hours work in the UK.

4 Sufficient ties tests

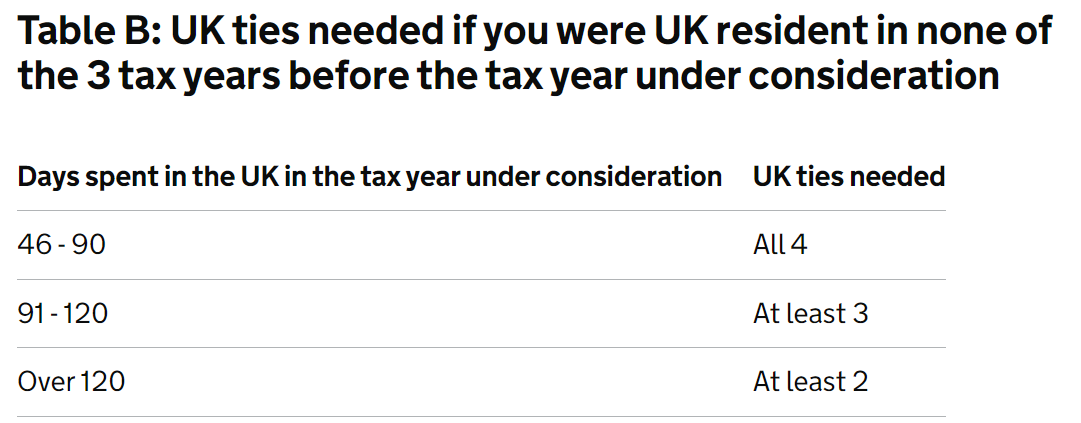

Where you do NOT meet the automatic UK residence tests AND the automatic overseas tests, you will be treated as UK tax resident if you have sufficient ties to the UK. If you were not a UK tax resident in any of the 3 tax years before the one you are considering, you will need to check if you have any of the following:

- a family tie

- an accommodation tie

- a work tie

- a 90 day tie (broadly, presence in the UK for at least 90 days)

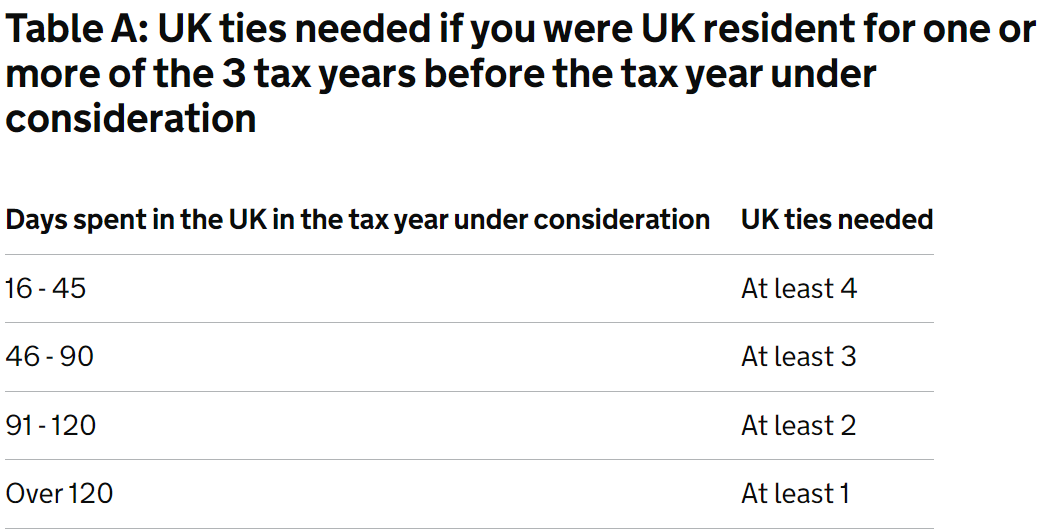

If you were tax resident in the UK in one or more of the 3 tax years before the one you are considering, you will also have to check whether you have a country tie. (i.e. if the UK is the country in which you were present at midnight for the greatest number of days in that year. This will also apply where there is more than one such country where you have spent the greatest number of days, and one of those countries is the UK).

The fewer UK ties you have, the more days you can spend in the UK without being considered as a tax resident in the UK. The following tables show this.