Marzen’s Related-Party Service Fee Tax Avoidance Strategy

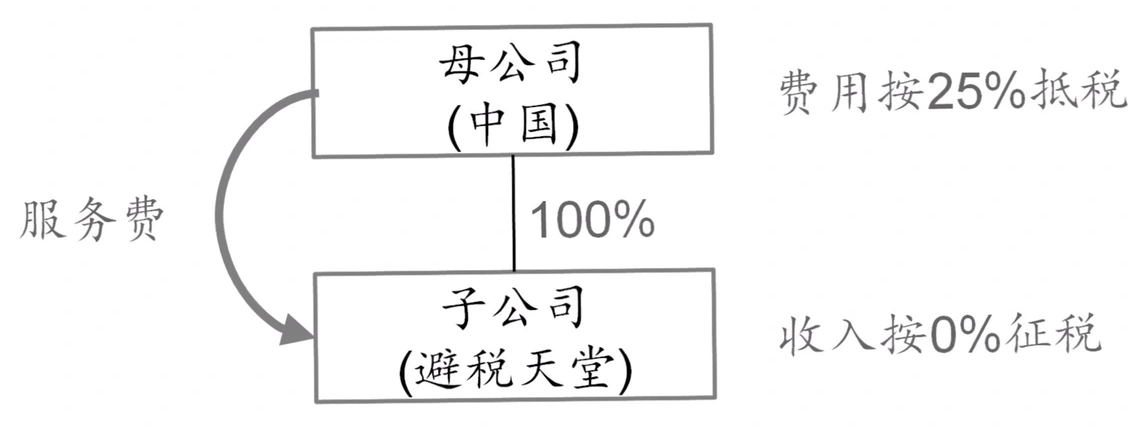

Every Chinese business dreams of tax avoidance: set up a subsidiary in a tax haven (or low-tax jurisdiction), such as the British Virgin Islands (BVI) or the Cayman Islands, and arrange for a Chinese company to pay service fees to this subsidiary. If the service fees are deductible for the Chinese company and tax-free for the subsidiary, then voilà—tax savings achieved! For example, if a Chinese company pays its subsidiary RMB 10 million in service fees, the former saves RMB 2.5 million in taxes while the latter pays nothing, resulting in an overall tax savings of RMB 2.5 million. Easy, right?

Well, if it were that simple, international tax experts would’ve been out of jobs long ago. While most people know such schemes don’t work, they often don’t understand why. And even if they were feasible, what’s the limit on the size of these service fees? To explore these questions, let’s look at a Canadian case: Marzen Artistic Aluminum v. Her Majesty the Queen.