How Foreign Tax Authorities Obtain Information on U.S. Residents' Financial Assets

We previously received comments from readers suggesting that as long as financial assets are held in U.S. brokerage accounts and the U.S. is not a CRS member country, the Chinese tax authorities cannot access information about these U.S. financial assets. So, can tax authorities in China and around the world really not obtain information about their residents' financial assets in the U.S.?

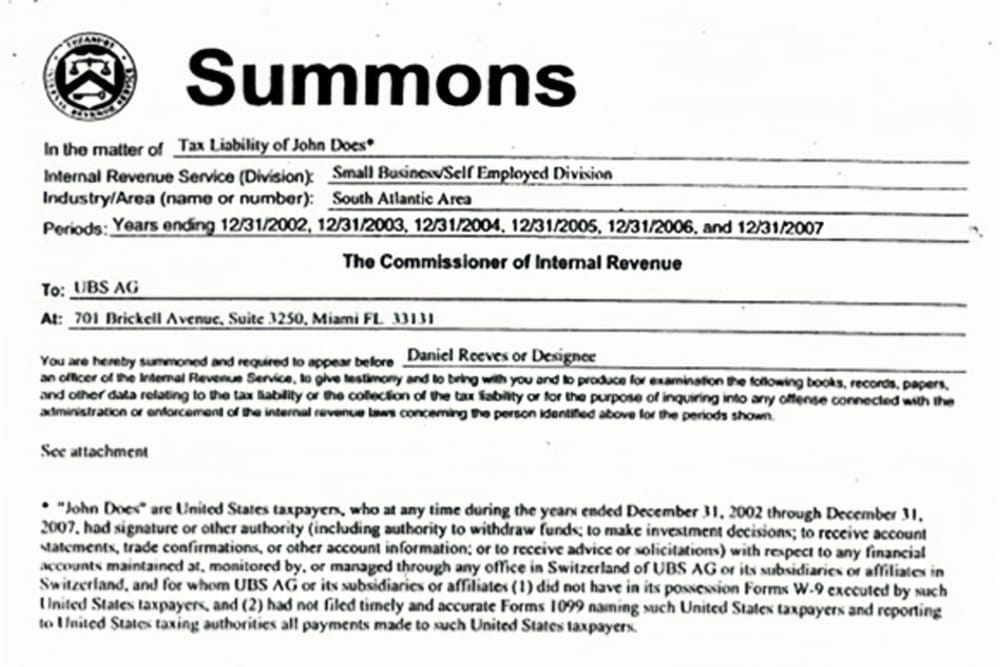

In this article, we will introduce one method by which global tax authorities can obtain information on their residents' financial assets in the U.S., specifically through the use of John Doe Summons. Some of the information in this article references Mark Morris's article published on June 25, 2024, titled "Hiding your money in the USA? IRS issues John Doe summonses to assist foreign governments track your ass. Far better than the meek OECD EOIR," and we have obtained his permission to use the relevant content.