IKEA's Tax Planning Strategies

In 2017, the European Union launched an investigation into IKEA’s large-scale tax avoidance practices. However, as of now, the investigation has yet to deliver any conclusions, indicating that IKEA’s tax strategies might be more complex than other cases. After all, IKEA is not a publicly listed company, and its public disclosures are limited. This lack of transparency allows the company to employ more flexible, private, and intricate tax planning strategies.

The EU’s decision to investigate IKEA was largely based on a 34-page report published in 2016 titled “IKEA: Flat Pack Tax Avoidance”. The report was commissioned by the Greens/EFA Group under the European Parliament, giving it a certain level of credibility. Since the case is still under investigation, and parts of the report are speculative rather than based on public records, the following analysis should be taken as a reference and not as confirmed facts.

According to the report, IKEA avoided paying at least €1 billion in taxes in Europe between 2009 and 2014. This was achieved through the following mechanisms:

- Before 2012: Using a Dutch company to collect royalties from IKEA stores worldwide and transferring the profits to a foundation in the tax haven of Liechtenstein.

- 2012–2014: Using a Dutch company to collect royalties but significantly reducing Dutch taxes through interest expenses, royalty payments, and amortization of intangible assets.

- 2012–2014: Using a Luxembourg company’s Swiss branch to provide intercompany loans, earning interest income, which was then transferred to the tax haven of Curaçao.

- 2005–2014: Using a Belgian company to benefit from tax incentives such as the Coordination Centre regime and Notional Interest Deduction.

I. How IKEA Avoided Taxes in the Netherlands Before 2012

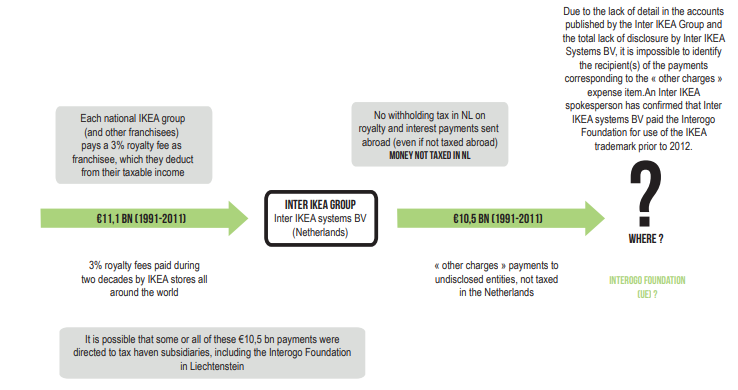

The diagram below summarizes how IKEA used royalties to avoid taxes before 2012. Inter IKEA Systems B.V. (“IIS”), shown in the center of the diagram, collected royalties equivalent to 3% of revenue from all IKEA stores worldwide for the use of the IKEA trademark. These royalties were deducted as pre-tax expenses by the stores, effectively transferring a portion of their profits to IIS.

While 3% of revenue might not sound like much, it actually represented a significant portion of profits. IKEA’s competitive advantage lies in its low prices, which means its profit margins are already thin. For example, in 2014, royalties accounted for 64% of the pre-tax profits of IKEA France! According to the report, IKEA transferred a total of €11.1 billion in profits to IIS between 1991 and 2011.

In theory, IIS’s €11.1 billion in profits should have been taxed in the Netherlands. However, IIS reported “Other Charges” of €10.5 billion paid to related parties, leaving only €600 million in taxable profits in the Netherlands. After deducting local expenses, IIS paid very little in Dutch taxes.

Though IIS’s financial statements did not disclose who received the €10.5 billion in “Other Charges,” we can make an educated guess based on similar tax avoidance cases, such as Starbucks:

- IIS was likely not the ultimate owner of the IKEA trademark. Instead, it was authorized to use the trademark by the ultimate owner. Therefore, the “Other Charges” were likely global licensing fees paid to the ultimate owner;

- IIS collected royalties in the Netherlands because the country’s extensive tax treaty network ensured the lowest withholding tax rates on payments made by the stores. At the time, the Netherlands also did not restrict deductions or impose withholding taxes on royalties paid to foreign entities;

- The ultimate owner was likely based in a tax haven, meaning the €10.5 billion was not subject to taxation. The report speculates that the profits were transferred to the Interogo Foundation in Liechtenstein, controlled by IKEA’s founder and others. While we cannot confirm the foundation’s tax status, Liechtenstein is a well-known tax haven, so the report’s speculation is plausible.