Extremely low effective tax rate for employment income in Hong Kong

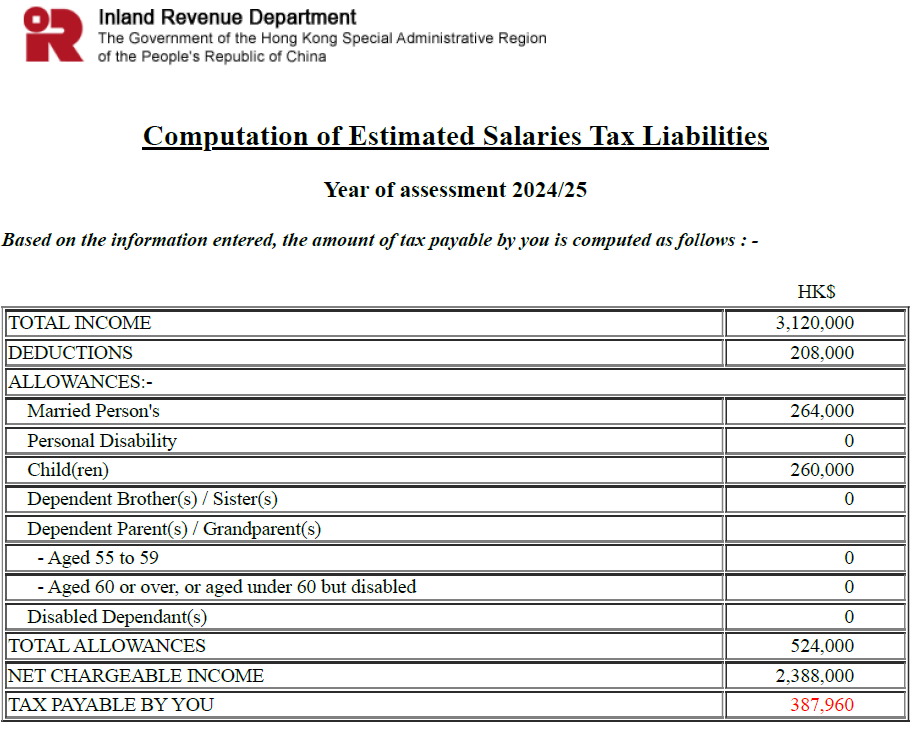

Hong Kong is one of the renowned tax havens in the world, its tax rate on employment income ("Salaries tax") is very low. Considering all the deductions and allowances provided by the Inland Revenue Ordinance, the effective tax rate (ie. actual tax expense divided by the income) is extremely low. For example, a family with 2 kids earning HKD 3,120,000 (equivalent to USD 400,000) can pay only HKD 387,960 (equivalent to USD 49,738) a year, an effective tax rate of around 12.4%. See a sample tax computation provided by the Inland Revenue Department of Hong Kong for the family below.

Let's check out how such family can enjoy such an extremely low effectively tax rate.

Nominal rate of Salaries Tax in Hong Kong

There are two types of tax rates in Hong Kong - one is the standard rate and another one is the progressive rate. The formulas below show how we apply two different rates:

Assessable income - deductions = Net assessable income (applying standard tax rate)

Net assessable income - allowances = Net chargeable income (applying progressive rate)

The standard tax rate is 15% and 16% for net assessable income below and above HKD 5,000,000 (equivalent to USD 641,026) respectively.

The progressive tax rate is 2% for hte first net chargeable income HKD 50,000, 6% for the next HKD 50,000, 10% for the next HKD 50,000, 14% for the next HKD 50,000, and 17% for the remaining net chargeable income.

You can see that the progressive tax rate is higher (up to 17%) than the standard tax rate (16%) but the taxpayer can enjoy the allowances in the progressive tax regime.

The taxpayer pays the Salaries Tax of the lower of the result from the standard rate and the progressive rate. Don't worry about the calculation - the tax authority will do it for you and choose the regime which is favourable to you.

Deductions

All the taxpayers can enjoy the deductions allowed by the Inland Revenue Ordinance. Deductions include but not limited to:

- Outgoing and Expenses

- Qualifying Premiums Paid under the Voluntary Health Insurance Scheme (VHIS) Policy

- Qualifying Annuity Premiums and Tax Deductible MPF Voluntary Contributions

- Domestic Rents

- Approved Charitable Donations

- Expenses of Self-education

- Contributions to a Mandatory Provident Fund Scheme or Recognized Occupational Retirement Scheme

- Depreciation and other capital allowances for plant and machinery

- Home Loan Interest

- Elderly Residential Care Expenses

You can check for further details on this website produced by the Hong Kong Government.

Allowances

Only the taxpayer under the progressive tax regime can enjoy the allowances. Allowances include:

- Basic allowance

- Married person’s allowance

- Child allowance

- Dependent brother or dependent sister allowance

- Dependent parent and dependent grandparent allowance

- Single parent allowance

- Disabled dependant allowance

- Personal disability allowance

You can check for further details on this website produced by the Hong Kong Government.

Applying to the family case

Though the family is facing up to 17% of the nominal tax rate, its effective tax rate is only 12.4% by claiming deductions and allowances (very common for a family) below.

- Outgoing and Expenses HKD 10,000

- The family claims annual fees paid to the professional bodies (ie. Certified Public Accountants).

- Self Education Expenses HKD 10,000

- The family claims tuition fee and the related examination fee paid for a prescribed course of education for gaining or maintaining qualifications for use in either a current or a planned employment.

- Approved Charitable Donations HKD 10,000

- The family claims the donations to the church in Hong Kong.

- Contributions to a Mandatory Provident Fund Scheme or Recognized Occupational Retirement Scheme HKD 18,000

- The family claims the contributions to their Mandatory Provident Fund Scheme required by their Hong Kong employment.

- Qualifying Annuity Premiums and Tax Deductible MPF Voluntary Contributions HKD 60,000

- The family claims the voluntary contributions made to their Mandatory Provident Fund Scheme following Warren Buffett advice in investing indexed-fund.

- The maximum deductible contributions are HKD 60,000 .

- Domestic Rents HKD 100,000

- The family claims the rent paid for an apartment rented in Hong Kong

- The maximum deductible contributions are HKD 100,000.

- Basic allowance HKD 132,000

- Every taxpayer can enjoy a basic allowance.

- Married person’s allowance HKD 132,000

- The family claims a married person's allowance as the couples are married, living together and one of them do not have any income chargeable to salaries tax.

- Child allowance HKD 260,000

- The family claims a child allowance for two children in the family, each HKD 130,000.