Google’s Double Irish with a Dutch Sandwich

In the European Union’s case against Apple’s tax planning, the core issue was Apple’s unique use of Ireland to avoid taxes: structuring a company to “split” into a Bermuda-based parent company and an Irish subsidiary, allowing most profits to flow to the tax-exempt Bermuda parent, resulting in over $100 billion in tax avoidance. In July 2020, the EU lost the case, partly because it couldn’t prove that Ireland offered such tax benefits exclusively to Apple. After all, Ireland is open for business when it comes to tax avoidance and certainly doesn’t cater only to Apple. So, how do other multinational corporations use Ireland to avoid taxes?

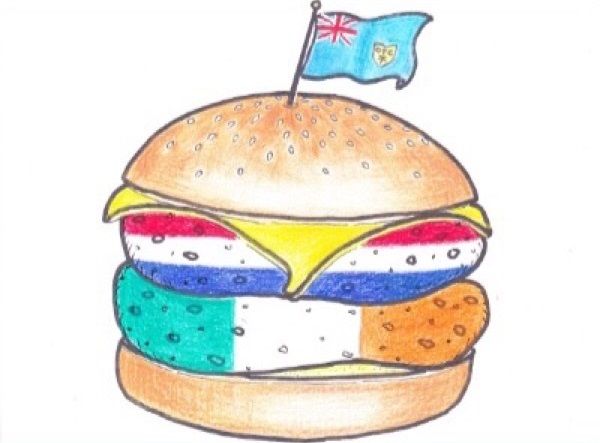

One particularly ingenious international tax arrangement is charmingly called:

The Double Irish with a Dutch Sandwich

The burger above summarizes this tax structure perfectly. At the base of the structure is an Irish company, sandwiched between a Dutch company in the middle and another Irish company at the top, which is managed from Bermuda. Under Irish tax law, the top Irish company is treated as a Bermuda-based company for tax purposes (hence the Bermuda flag floating above it in the diagram). Here’s how the tax mechanism works:

I. How the Sandwich Works

1. The Bottom Irish Company

The bottom Irish company directly sells products and earns revenue worldwide, paying Ireland’s corporate income tax rate of 12.5%.

2. The Top Irish Company

The top Irish company holds significant intellectual property (“IP”) rights but is managed from Bermuda. Under Irish tax law at the time, companies managed overseas were not subject to Irish taxes. This top Irish company charges the bottom Irish company substantial royalties for using its IP, leaving the bottom Irish company with minimal taxable profits in Ireland. Meanwhile, the top Irish company doesn’t pay taxes in Ireland (because it’s managed from Bermuda) or in Bermuda (a tax haven).

Why not use a Bermuda-based company directly instead of an Irish one? This was to avoid U.S. tax rules at the time. If the company were based in Bermuda, the U.S. would tax it under Controlled Foreign Corporation (“CFC”) rules. However, by using an Irish company (even if managed from Bermuda), Google could sidestep U.S. CFC regulations.

3. The Middle Dutch Company

Why add a Dutch company in the middle? Irish tax law required the bottom Irish company to withhold taxes on royalties paid to the top Irish company, as the latter was considered a tax haven under Irish law and thus ineligible for withholding tax exemptions.

The Dutch company was inserted to bypass this withholding tax. The bottom Irish company paid royalties to the Dutch company, which, under the Ireland-Netherlands tax treaty, was exempt from withholding tax. The Dutch company then transferred the royalties to the top Irish company. Under Dutch tax law at the time, no withholding tax was applied to these payments either. This allowed the royalties to flow to the top Irish company without any withholding tax.