EU Personal Tax Incentives

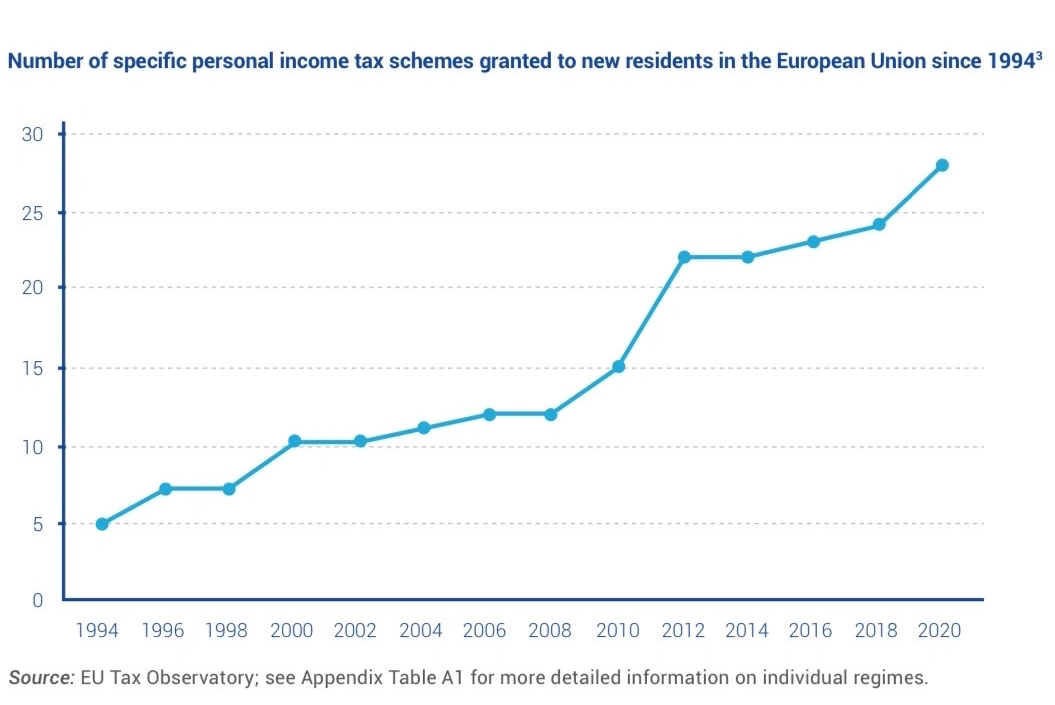

The EU Tax Observatory published "New Forms of Tax Competition in the European Union: An Empirical Investigation" in November 2021. Figure 2 on page 11 shows statistics on EU personal tax incentives. The graph indicates a steady increase in personal tax incentives offered by EU countries, rising from 5 in 1994 to 28 in 2020, with no signs of slowing down.

As discussed in our "BEPS" and "BEPS 2.0" series, the EU is one of the world's most active anti-tax avoidance organizations. While they've successfully prevented multinational corporations from arbitrarily shifting profits to tax havens, eroding tax bases in high-tax jurisdictions, and forced companies to pay a minimum 15% global tax, why does the EU fight corporate tax avoidance while attracting individual tax avoidance?