How Coca-Cola Avoided USD 3.4 Billion in Taxes

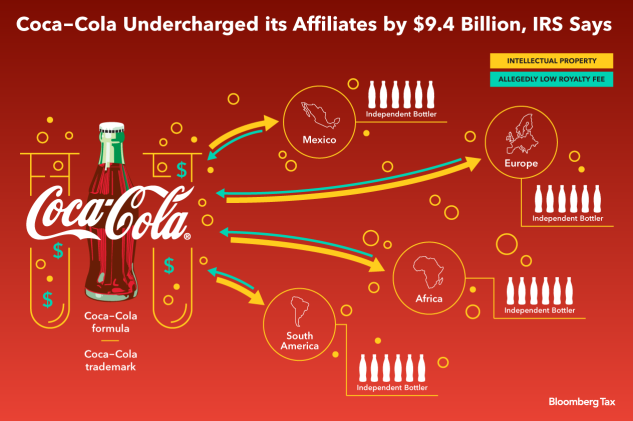

Between 2007 and 2009, Coca-Cola used royalties to transfer profits to related entities. The Internal Revenue Service (“IRS”) argued that these royalties were below the fair market value that independent third parties would have paid (violating transfer pricing rules) and demanded USD 3.4 billion in taxes. Coca-Cola disagreed and appealed the decision.

In November 2020, the U.S. Tax Court ruled in favor of the IRS. Coca-Cola then hired former federal judge J. Michael Luttig to assist in its appeal. Let’s take a closer look at this case.