Why Cairn Energy Froze Indian Government's Assets

On 8 July 2021, Cairn Energy successfully froze 20 properties owned by the Indian government in Paris, France, valued at over €20 million. Two months earlier, Cairn Energy had filed a lawsuit against Air India in the U.S. District Court for the Southern District of New York, claiming that Air India, as a state-owned enterprise, should represent the Indian government in compensating Cairn Energy.

Who is Cairn Energy, and how did it manage to sue a big country and freeze its assets?

Cairn Energy is an Edinburgh-based energy company with a market capitalization of approximately $750 million—a very small fraction compared with the oil and gas giant like Saudi Aramco, which worth more than $1 trillion. Despite being a relatively small company, Cairn Energy is well-known in the world of international taxation due to its prolonged $1.6 billion tax dispute with the Indian government.

Cairn Energy’s tax dispute is strikingly similar to the Hutchison/Vodafone case, as both involve capital gains tax arising from the indirect transfer of shares overseas. However, this article will not delve into the intricacies of capital gains tax or India’s retroactive tax laws dating back 50 years. Instead, we will focus on the role of the Bilateral Investment Treaty (“BIT”) in this case.

In this article, we will outline the background of the tax dispute and explain how this British company leveraged the BIT as a legal tool to protect its legitimate rights. Many companies operating abroad often overlook the use of international legal instruments to safeguard their interests. We hope this article raises awareness about the importance of protecting corporate rights.

I. Background of the Tax Dispute

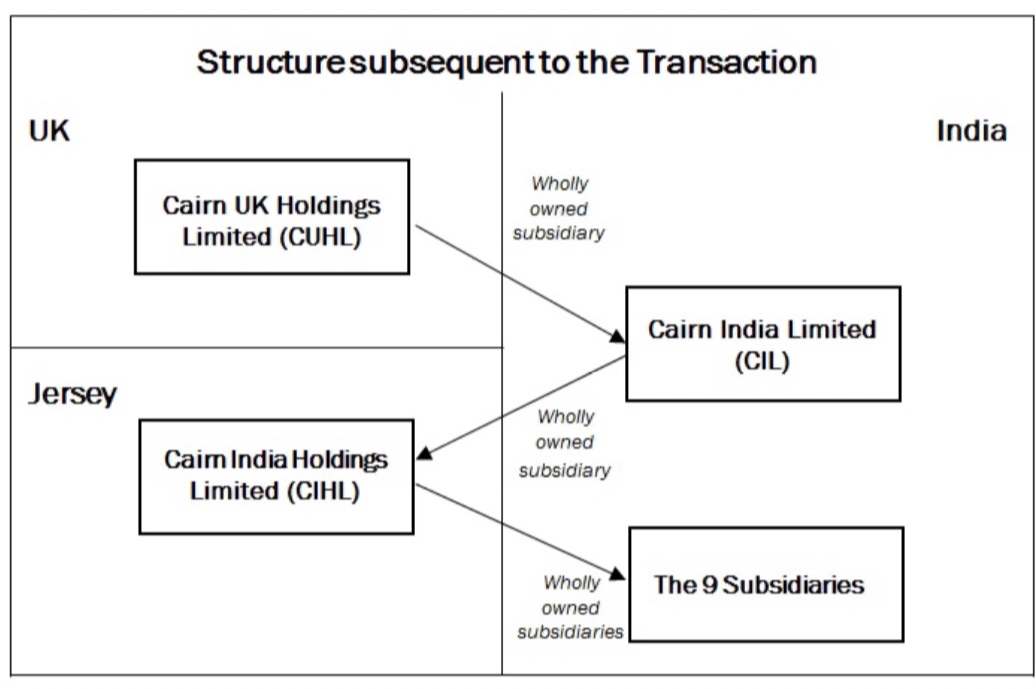

In 2006, Cairn Energy planned to list its Indian assets on the Indian stock market. However, the Indian stock exchange required listed companies to be registered in India. At the time, Cairn Energy directly and indirectly held nine Indian companies through its UK-based holding company, Cairn UK Holdings Limited (“CUHL”). To meet the listing requirements, Cairn Energy carried out a two-step internal share restructuring. The post-restructuring structure is illustrated below:

Step 1: CUHL transferred its direct and indirect interests in the nine Indian companies to Cairn India Holdings Limited (“CIHL”), a wholly-owned subsidiary registered in Jersey. The capital gains from the direct transfer of Indian companies were taxed in India, but the capital gains from the indirect transfer were not taxable under the tax laws at the time.

Step 2: CUHL transferred all its interests in CIHL to Cairn India Limited (“CIL”), a wholly-owned subsidiary registered in India. CIL successfully went public on the Indian stock exchange by the end of 2006.

For years, everything remained peaceful. However, in 2012, after losing the Hutchison/Vodafone case, the Indian government amended its tax laws to retroactively tax indirect share transfers going back to 1962. As a result, the capital gains from the first step of Cairn’s restructuring became subject to Indian capital gains tax. From that point on, Cairn Energy faced a series of challenges:

- 2014: The Indian tax authority launched an investigation into Cairn Energy.

- 2015: The Indian tax authority issued a $1.6 billion tax bill (excluding interest and penalties). Cairn Energy contested the bill in Indian courts and the Arbitration Tribunal of The Hague.

- 2016–2018: The Indian tax authority seized $150 million in dividends owed to Cairn Energy, canceled $230 million in tax refunds, and sold $220 million worth of Cairn Energy’s shares.

- December 2020: The Arbitration Tribunal of The Hague ruled in favor of Cairn Energy, ordering the Indian government to pay $1.2 billion in compensation (excluding approximately $500 million in interest and costs).

- March 2021: The Indian government appealed the Tribunal’s ruling.

- May 2021: Cairn Energy, leveraging the arbitration ruling, sued Air India in New York, claiming it as a state-owned entity responsible for paying the compensation.

- July 2021: Cairn Energy successfully froze Indian government assets worth approximately €20 million in Paris. Meanwhile, Cairn Energy also appealed the tax dispute in India’s Delhi High Court, though no ruling has been made so far.

Cairn Energy does not wish to engage in a prolonged battle with the Indian government. Suing Air India and freezing assets are merely tactics to bring the Indian government back to the negotiation table. Cairn Energy has expressed its willingness to reinvest the disputed amount in India, but the government has refused. Given the Indian government’s determination to appeal and Cairn Energy’s significant stake in the matter, this six-year-long case is likely far from over. (KCG note: This case saw significant developments after July 2021 and will be updated in the future.)