Bristol-Myers Squibb's Tax Planning Strategy

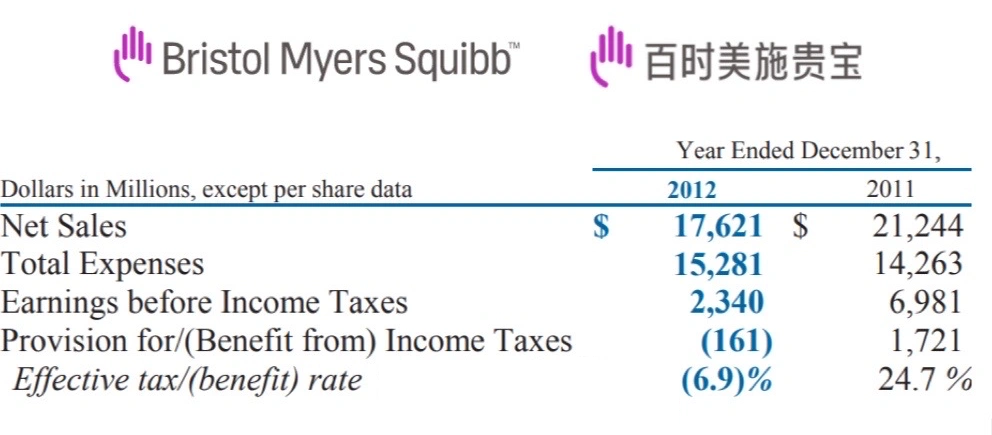

On January 18, 2022, U.S. Senate Committee on Finance Chairman Ron Wyden sent an open letter to Giovanni Caforio, Chairman and CEO of Bristol-Myers Squibb (BMS), demanding an explanation for the company's dramatic tax rate reduction - from 24.7% in 2011 to negative 6.9% in 2012, resulting in a $1.4 billion tax reduction.

During an earnings call with analysts on January 24, 2013, when questioned about the significantly lower effective tax rate compared to industry peers, then-CFO Charles Bancroft briefly attributed it to "tax planning strategies," mentioning a Q4 2012 reorganization of certain entities and income optimization. He provided no specific details about the substantial tax reduction. Since the financial statements had been audited, analysts, while perhaps skeptical, didn't question the numbers' authenticity - after all, improved profitability rarely faces scrutiny.

The following excerpt from BMS's 2012 audited financial statements shows income tax expense plummeting from $1.7 billion in 2011 to negative $160 million in 2012, with a dramatic drop in the effective tax rate. What exactly did BMS do to achieve this? How did their effective tax rate suddenly plunge from 24.7% to negative 6.9%?